What is the market cap of all cryptocurrencies

One of the chief characteristics of Bitcoin (BTC) is its limited coin supply. Bitcoin inventor Satoshi Nakamoto, the anonymous name used by the creator(s) of the Bitcoin cryptocurrency, designed the cryptocurrency with a cap to limit the supply rich palms casino review. This increases its scarcity over time, which tends to increase demand and price.

As we’ve seen, miners must hash the block header repeatedly using different nonce values. They do so until they find a valid block hash. When a miner finds a valid block hash, they broadcast this block to the network. Then, all other validating nodes will check if the block is valid and, if so, add the new block to their copy of the blockchain.

The root hash and the hash of the previous block cannot be changed, so miners must change the nonce value several times until a valid hash is found. In order to be considered valid, the output (block hash) must be less than a certain target value determined by the protocol. In Bitcoin mining, the block hash must start with a certain number of zeros — this target value is known as the mining difficulty.

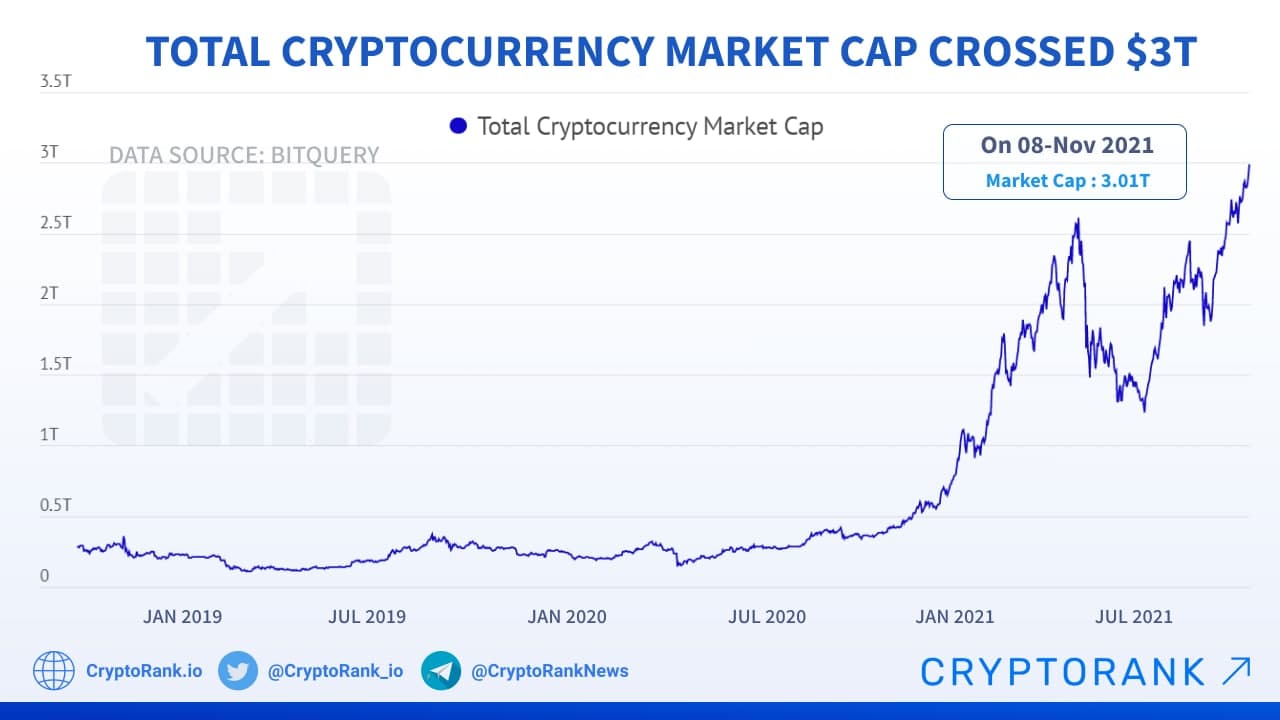

Market cap of all cryptocurrencies

Cryptocurrency works through networks of nodes that are constantly communicating with each other to stay updated about the current state of the ledger. With permissionless cryptocurrencies, a node can be operated by anyone, provided they have the necessary technical knowledge, computer hardware and bandwidth.

Crypto market capitalization or „crypto market cap” for short is a widely used metric that is commonly used to compare the relative size of different cryptocurrencies. On CoinCodex, market cap is the default metric by which we rank cryptocurrencies on our frontpage. We also track the total cryptocurrency market cap by adding together the market cap of all the cryptocurrencies listed on CoinCodex. The total market cap provides an estimate on whether the cryptocurrency market as a whole is growing or declining.

ICO stands for Initial Coin Offering and refers to a method of raising capital for cryptocurrency and blockchain-related projects. Typically, a project will create a token and present their idea in a whitepaper. The project will then offer the tokens for sale to raise the capital necessary for funding development. Even though there have been many successful ICOs to date, investors need to be very careful if they are interested in purchasing tokens in an ICO. ICOs are largely unregulated, and very risky.

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

Cryptocurrencies such as Bitcoin feature an algorithm that adjusts the mining difficulty depending on how much computing power is being used to mine it. In other words – as more and more people and businesses start mining Bitcoin, mining Bitcoin becomes more difficult and resource-intensive. This feature is implemented so that the Bitcoin block time remains close to its 10 minute target and the supply of BTC follows a predictable curve.

All the cryptocurrencies

People invest in cryptocurrencies for various reasons, including financial freedom, supporting blockchain technology, participating in decentralized finance (DeFi) ecosystems, exploring new investment opportunities, owning digital collectables (NFTs), hedging against traditional markets, and fostering global economic inclusion. These unique qualities and potential offered by digital assets attract individuals seeking to diversify their portfolios and contribute to technological innovation.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

On the other hand, tokens are digital assets that are not native to a particular blockchain but are created on existing blockchain platforms, typically through tokenization. Tokens can represent various types of assets, such as utility tokens, security tokens, or non-fungible tokens (NFTs). They can be easily created using templates, where developers specify parameters like initial supply, number of decimals, and other metadata. Most tokens are created on established blockchain networks like Ethereum, using standards such as ERC-20 for fungible tokens and ERC-721 for non-fungible tokens.

To add a new coin to Blockspot.io, fill out our submission form with all the necessary details, such as name, ticker, logo, type, supply, and other metadata. The form can be accessed at Submitting a coin to our platform is completely free, and we’ll review your submission before adding it to our extensive database of cryptocurrencies.

NFTs are multi-use images that are stored on a blockchain. They can be used as art, a way to share QR codes, ticketing and many more things. The first breakout use was for art, with projects like CryptoPunks and Bored Ape Yacht Club gaining large followings. We also list all of the top NFT collections available, including the related NFT coins and tokens.. We collect latest sale and transaction data, plus upcoming NFT collection launches onchain. NFTs are a new and innovative part of the crypto ecosystem that have the potential to change and update many business models for the Web 3 world.