Posts

Range 5 out of Worksheet 1-5 shows that might owe an extra $4,459 immediately after deducting your withholding to the 12 months. You might get into a supplementary matter to your possibly of one’s Forms W-4, or split they among them people. You choose to feel the additional count withheld from your mate’s wages, so your companion gets in $91 ($4,459 ÷ 49 leftover paydays) to their Form W-cuatro inside Step four(c).

Second Stimulus Look at Earnings Thresholds

Go to Internal revenue service.gov/Variations to access, install, or click this printing all models, recommendations, and you can publications you will need. The following Irs YouTube streams give short, educational movies on the individuals tax-related information inside the English, Spanish, and you will ASL. To the Irs.gov, you should buy up-to-go out information on current incidents and alterations in tax law.. Is the nonrefundable credits you would expect to claim because of occurrences that will occur within the months. In case your amount online 1 comes with an internet financing obtain otherwise qualified returns, play with Worksheet 2-8 to figure extent to enter on the internet 10.. Be sure to think deduction limits realized on the Plan An excellent (Setting 1040), such as the $10,100000 limitation to your state and you will local fees.

Most local casino incentives – in addition to no-deposit also provides – come with a couple of laws and regulations and limits. Otherwise, the new casino might confiscate the extra and anything you have the ability to victory of it. If you plan to produce a free account in the a different online gambling enterprise that gives a pleasant no deposit added bonus, chances are high it might be waiting for you on your own membership when you complete the membership process. The advantage are activated immediately and able about how to begin to experience.

Prices is actually per visitor and implement in order to minimal direct-within the kinds for the a space offered base in the duration of booking. Fares are non-heavens, cruise- otherwise cruisetour-merely, based on twice occupancy and apply to the first two visitors inside the a stateroom simply. These types of fares do not connect with singles otherwise 3rd/fourth-berth website visitors. All cruise costs is actually including authorities-imposed taxation and charges. Government-enforced fees and charges are at the mercy of change and you can PCL supplies the authority to collect people grows in place during the time out of cruising even if the fare had been paid-in complete.

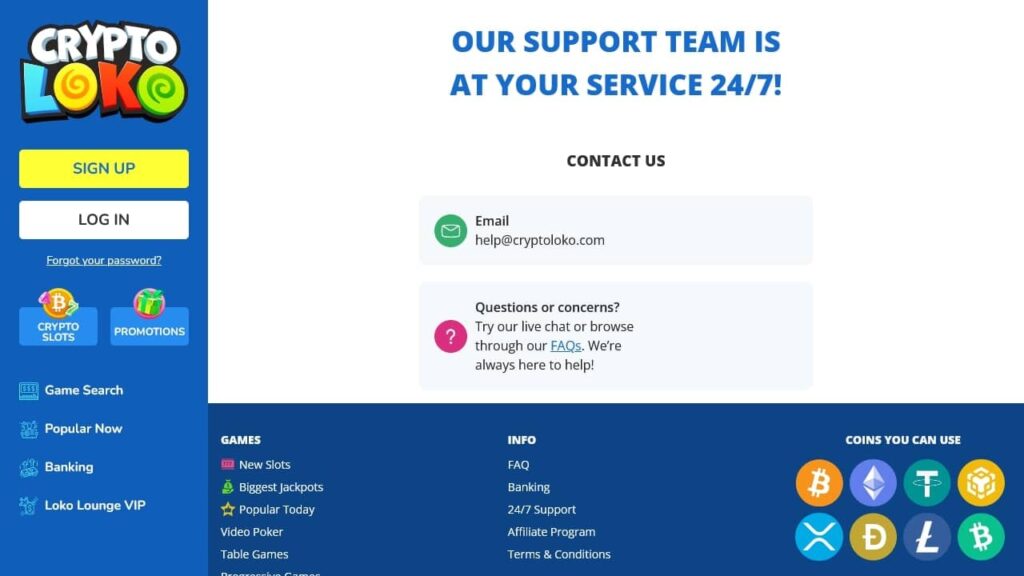

No-put added bonus FAQ

Dough Savings is an internet bank that offers an excellent higher-yield family savings and you may nine regards to Dvds which also have competitive production. Money Discounts requires at the very least $one hundred to open so it checking account. Dvds are best for someone looking a guaranteed speed of get back that is typically greater than a family savings. In return for increased rates, fund is actually fastened to have a flat time frame and you will early withdrawal penalties can get apply.

- Although not other round of a single-go out stimuli take a look at repayments is apparently decideded upon by Republicans and you can Democrats, and the standard opinion is for a good $1200/$2400 payment within the August.

- With our top-notch info and you may suggestions, you’ll become well on your way to creating by far the most out of your cellular gaming escapades.

- For individuals who expect you’ll allege itemized write-offs on the 2025 taxation go back, go into the projected matter on the web 2a.

- To be sure companies comply with government income tax regulations, the fresh Irs inspections tax filings and you will repayments by using a mathematical system to spot taxpayers.

- Never tend to be one income tax withheld because of the a third-group payer from unwell spend even although you said it to your Variations W-dos.

The new payer of one’s your retirement or annuity need give you an excellent observe telling you about your directly to favor not to have tax withheld. Function W-4S stays in essence until you alter or cancel they, or end finding repayments. You could potentially improve your withholding by providing a new Mode W-4S otherwise a composed notice for the payer of the ill shell out. For individuals who found repayments lower than an agenda where your employer does not participate (including any sort of accident or wellness plan the place you paid all the the brand new superior), the newest payments are not ill pay and so are maybe not nonexempt. While the value of your own entry to a manager-given automobile, truck, or other street automobile is actually nonexempt, your employer can choose to not keep back tax thereon amount. If you works simply part of the seasons as well as your company believes to make use of the new part-season withholding strategy, reduced taxation was withheld from per salary fee than create end up being withheld for those who has worked all-year.

Risk.you has many constant campaigns due to its well-known Stake Us added bonus lose password system that has daily added bonus bundles, a weekly raffle, and you will multiplier falls to increase your bankroll. You must manage another Impress Vegas account to help you claim which limited-time offer. Come across less than for the best no-deposit bonuses and ways to allege him or her. Discover lower than to find the best no-deposit bonuses to own July 2025 and ways to cash out your no-deposit added bonus currency while the easily to.

Brokered Dvds also come having many voucher percentage frequencies. Your Computer game would be Callable otherwise Label Safe, giving you the flexibility to decide a probably higher level today in return for the risk of the newest Computer game being called aside away from you. Rather you could potentially prefer Label Protection, that gives your more certainty out of a rate away from come back over an exact months. In the end, you can even prefer an excellent Computer game who may have one step-right up voucher schedule. Which discount rates pays a fixed interest rate matter to own an excellent defined period and will then raise, at which area the fresh Cd will pay the new high desire speed up to it alter once again such like through the readiness time.

Having the ability to find the amount of their identity deposit is leave you self-reliance. It indicates you might lock out your bank account to possess a predetermined months that best suits you, and now have confidence regarding the interest it will earn. Term deposits allows you to delight in a well-known rate away from go back to own a fixed period of time, always from a single day to five years. Betting standards reference the number of times you should bet your extra before you can withdraw. The lower the newest betting requirements, the more positive the main benefit. That have large betting requirements, you may need to generate in initial deposit and you will gamble via your individual money before meeting these bonus conditions.

Find commission Faq’s on the next round away from repayments, that can and sign up for more part now. This informative article will bring status, money qualification thresholds and you will Faqs to the in past times acknowledged and proposed stimulus checks, known as Economic Impact costs. We and felt users’ put alternatives each account’s substance volume. I grabbed into consideration CNBC Discover audience study whenever available, such standard demographics and you will engagement with your blogs and you can devices.

Friend Bank Family savings

You could afford the amount owed revealed for the Form 941 by the borrowing or debit credit. Your own fee might possibly be canned by the a fees processor that will charge a running payment. Avoid using a credit otherwise debit card to make government income tax places. For more information on paying your fees that have a cards or debit cards, check out Irs.gov/PayByCard. If you can’t complete in initial deposit exchange on the EFTPS because of the 8 p.meters.

Finest New Financing Advertisements (Around 2.65% p.an excellent.)

For many who have a wants subsequently to help you instantaneously withdraw otherwise transfer fund, almost every other deposit things can be considerably better for you. Very early withdrawal fees will apply and also the account have a tendency to incur an appeal losing respect from the cash taken or moved early. For individuals who withdraw finance prior to the readiness day, you could happen fees and you will a reduction in the attention gained.

Friend Financial operates online, giving checking and offers membership, a finance market account, Dvds, credit cards having FICO Score access, mortgage loans, automobile and private money, as well as financing points. You can find a savings account at the regional bank, but when you want to secure a top rates and spend a low charge, you need to know storage their offers inside the an internet account. Without any additional expenditures away from highest part networks, on the web banks and you may nonbank business have the ability to render much more positive productivity than just national brick-and-mortar financial institutions. Learn more about the most used economic alternatives from the Category Gambling enterprises, to gamble online with spirits. Making your own playing expertise in addition compared to that, explore credible possibilities such e-purses, cryptocurrencies, and you may borrowing from the bank/debit notes. Joining refers to bringing earliest information and you may guaranteeing your own own name, a simple way to make certain defense and you may judge conformity in the legitimate web based casinos.

To the outlines 12a because of 12c, profile the total amount you should pay money for 2025, thanks to withholding and projected income tax payments, to avoid spending a penalty. If you along with your spouse can also be’t create mutual estimated taxation money, apply these types of laws and regulations for the separate estimated income. Projected income tax is the procedure always pay tax on the income one to isn’t at the mercy of withholding. Including earnings out of notice-a job, attention, returns, book, development on the sale away from property, prizes, and you can honors. You may also have to pay estimated income tax in case your number of money tax becoming withheld from the paycheck, retirement, or other income isn’t sufficient. Your boss have to overview of Function W-2 the entire of your nonexempt fringe advantages paid back otherwise addressed while the paid for you inside seasons and also the income tax withheld for the pros.